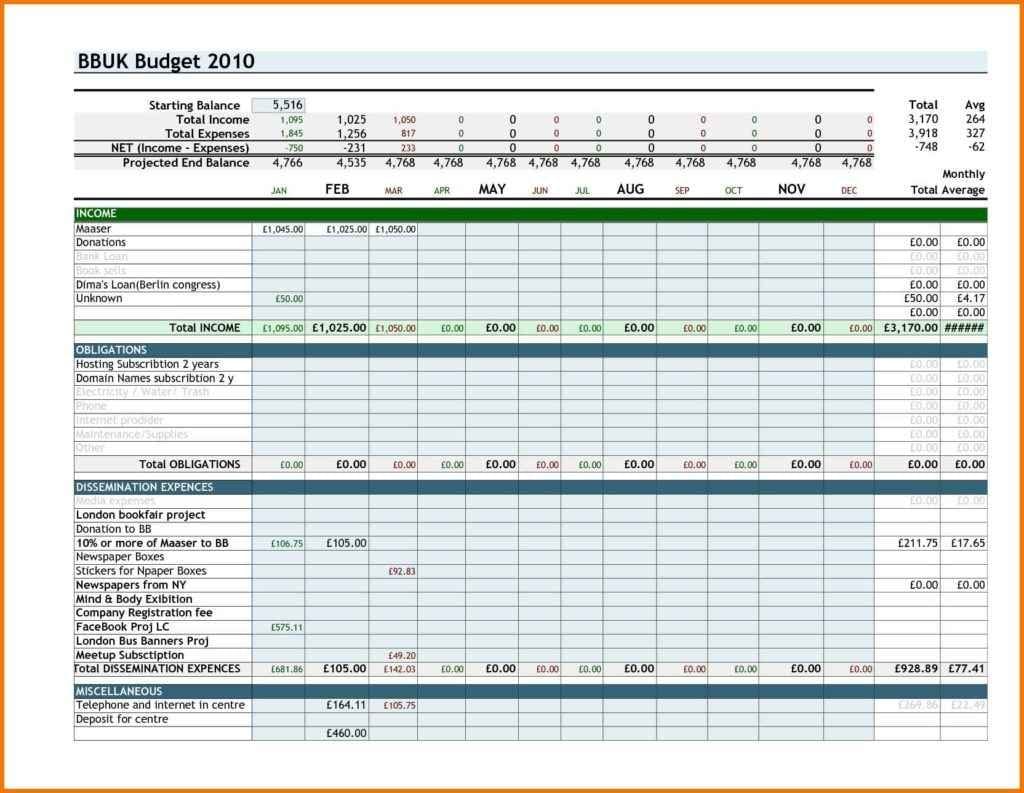

The amount you have to pay the employee (before deductions)ĭeductibles other than income tax like TDS, EPF, PT, etc. Total hours the employee worked overtime in a month or a particular pay period. Pay an employee earns for working beyond the regular working hours. Total hours the employee worked in a month or a particular pay period. Total money an employee earns for one hour of work. Enter the column names in the following hierarchy: Sr. Next, add some columns in the sheet to add data like employee name, pay/hour, total hours worked, etc., for the payroll calculation. Save the file in a preferred location so you can easily access the file whenever you need. Note: We have included screenshots of Excel for each step, making it simple for you to follow along with the process. We have provided a downloadable payroll template in Excel for your better understanding.

Let’s understand how to make Payroll in Excel with a few steps. Example: How to make Payroll in Excel? (Stepwise)Įxample: How to Make Payroll in Excel? (Stepwise).This article will show you the step-by-step process of how to create payroll in Excel using a very simple example. It has a vast range of formulas and a very simple layout, making it easy to use. The perfect tool that fulfills all these requirements is Microsoft Excel. So, companies that want to create payroll internally need a powerful, flexible, user-friendly, and easy-to-use tool. However, some businesses prefer to manage payroll on their own because it gives them complete control over their employees’ pay and expenses. To simplify the process, many companies rely on software like Tally or ADP or even outsource payroll to external service providers. Managing payroll manually can take up a lot of time and resources. Companies use Payroll in Excel to perform pay-related calculations like in-hand salary, deductions, and taxes for their employees using Microsoft Excel.

0 kommentar(er)

0 kommentar(er)